Grace Freeman, Sage Intacct Consultant for Percipient, gives us her overview of what you can expect from Sage Intacct’s first software update for 2023 (R1 2023).

What’s new in the latest release?

Save time applying credits to bills

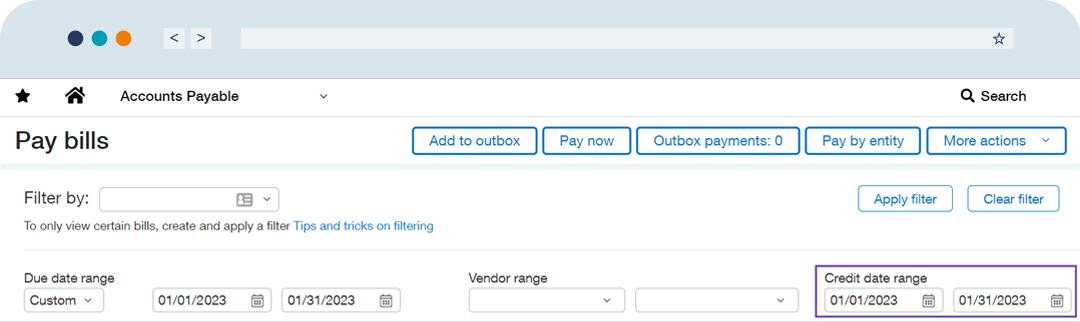

You can now use an on-the-fly filter in the pay bills list to restrict available credits to a date range. When you filter by credit range along with the due date, you can view a list of bills that includes only the available credits created during a corresponding time frame.

For example, say you are paying bills for January and only want to apply credits with transaction dates in the same month.

Previously, after filtering the bills by the due date, you had to individually evaluate each bill with available credits. This meant drilling down to the line details and then the credit details, noting the transaction dates for the credits, and selectively applying credits based on that information.

Now, after filtering using the same date range for the due date and credits, you can select bills, click ‘apply credits’, and be done.

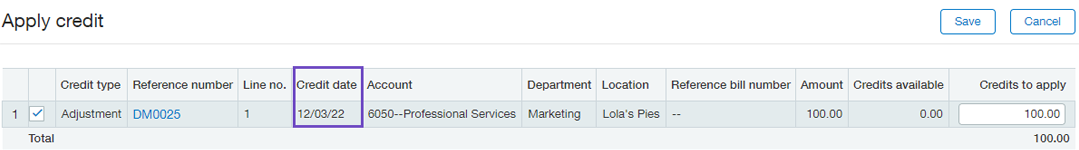

In addition to the new filter, you can now view the credit date when you drill down to credit details, without needing to open the credit transaction.

Creation rules now support VAT & GST

Minimize the time required to enter known recurring bank transactions and save even more time during reconciliation.

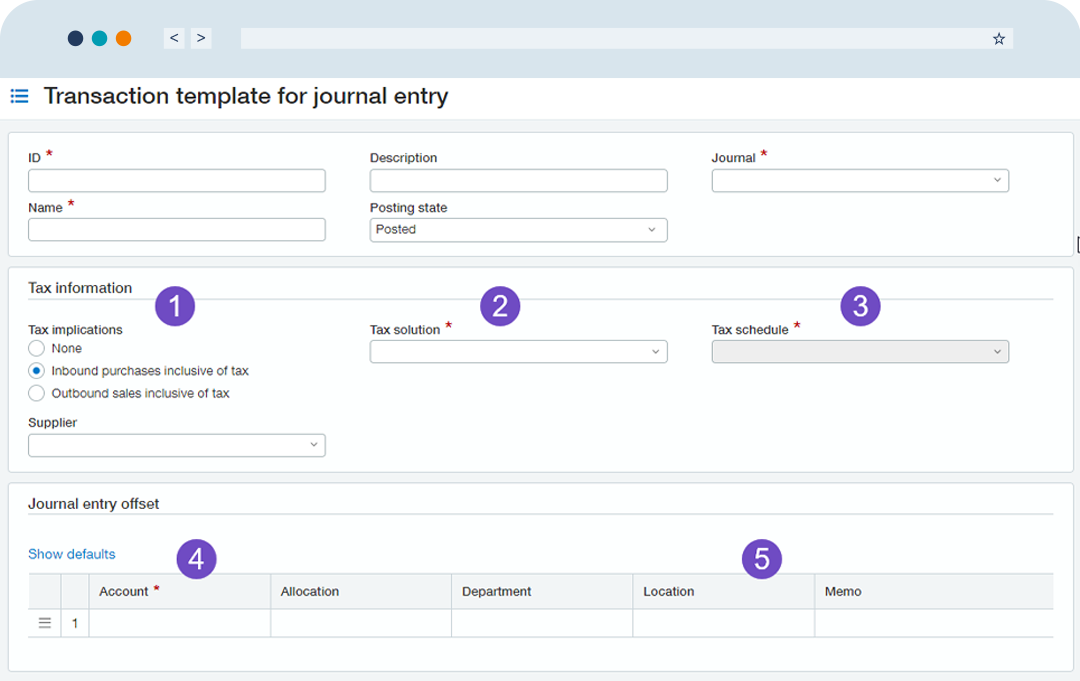

You can now define transaction templates to include tax implications for your VAT and GST tax needs. When a new transaction is created, tax is accounted for so you do not need to adjust the transaction afterwards.

For VAT or GST-enabled companies, you can now automatically include a tax on journal entries and credit card transactions created using a creation rule.

Just use a transaction template to calculate and record VAT or GST on created transactions and select an existing tax schedule. Then, add the transaction template to a creation rule. Add the creation rule to a rule set which you can then apply to an account.

This feature is only for inclusive taxes.

Sage University

All Sage Intacct training courses are now part of Sage University.

Sage University provides the same great learning resources you’re used to, but with more guided, role-based learning paths focused on your success. Connect to Sage University from within Sage Intacct for a seamless experience between Intacct and the training you need.

If you have an account at the Sage Intacct Learning Center, all your completed training is waiting for you at Sage University.

You still need to create a Sage account. Just use the same email address associated with your Sage Intacct Learning Center account when creating your Sage account to connect to your training records.

Other Highlights

- Choose how the trial balance report shows opening and closing balances

A new checkbox that lets you choose to show opening and closing balances as debits and credits combined or as debits and credits separately. - New payment object for reporting

A new accounts receivable payments object so you can run a centralised and detailed report for all AR payment transactions. - New permissions reports

Two new reports to simplify tracking and managing user permissions. - List enhancements

More customers now have a chance to experience list enhancements in beta – turn on the lists beta interface to see how you can personalise your list views, leverage advanced filters, manage list and record details side-by-side, and much more.

These highlights are only a few of the many new features and enhancements that have come to Sage Intacct in the latest release. If you are a current Sage Intacct customer and want to learn more, you can read the full release notes and watch the highlights video for R1 2023 here.

Sage Intacct Partner UK

The next Sage Intacct release date is due in May 2023. For more information on Sage Intacct or the latest software release, get in touch, or call us on 01606 871332.