SAGE INTACCTFOR SAAS & TECH

Multi-award-winning Sage Intacct partner

Cloud-BasedFinance Software for SaaS & Tech

Sage Intacct is a powerful SaaS accounting software built for fast-growing SaaS companies. Supporting the needs of a software-as-a-service business model, our Sage Intacct solutions help to automate complex accounting processes with real-time visibility of critical SaaS metrics

Download Our Guide

to Sage Intacct

Download now

WHY CHOOSE SAGE INTACCT?

As one of the fastest-growing industries, SaaS offers organisations enhanced levels of accessibility, simplicity and affordability. But the way SaaS and technology providers deliver their services can make their accounting processes anything but simple.

Whether you’re a scaling start-up or an established enterprise, Sage Intacct is the SaaS accounting software that’s built to manage your SaaS and technology business.

With integration as standard, Sage Intacct is uniquely configured to match your unique industry needs. Delivering automation and control around billing, accounting and reporting.

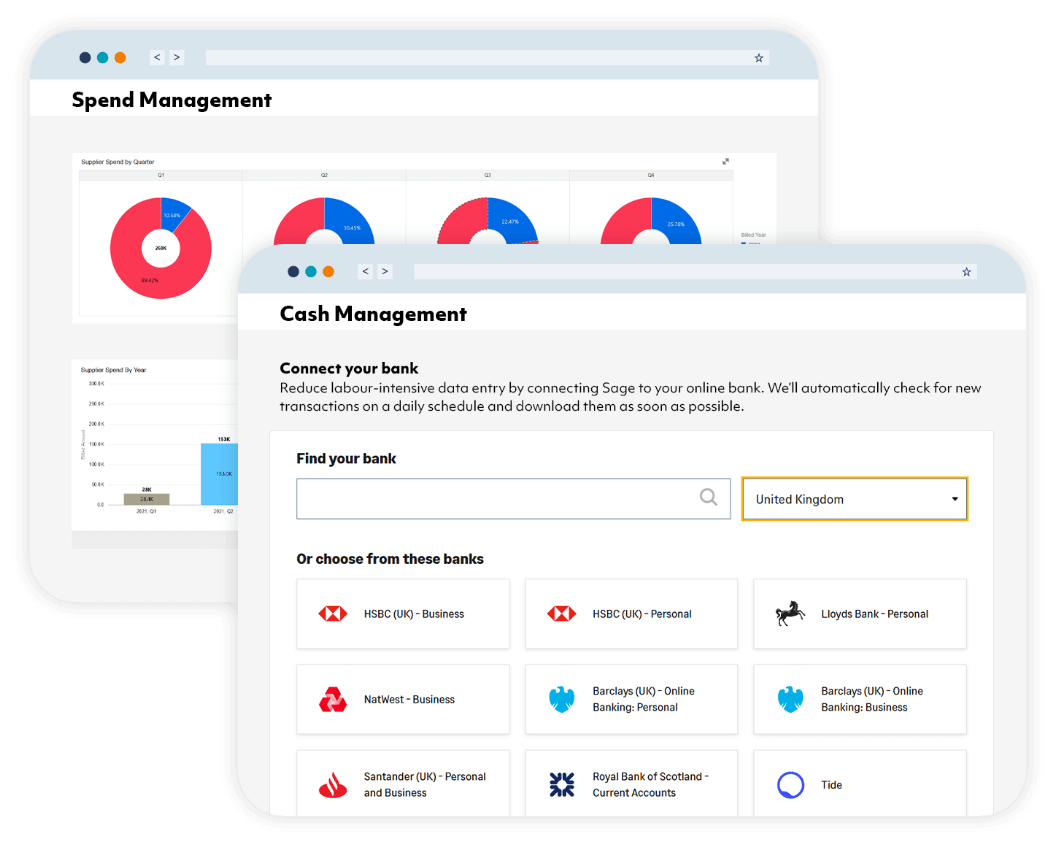

- Core FinancialsTransform your business strategy and processes with Sage Intacct's powerful, automated core accounting software, eliminating tedious manual processes to free your team.

- Dashboards & ReportingTurn data into insights and reach peak performance with rich, flexible, and real-time financial reports and customisable dashboards.

- PlatformCustomise, integrate, and extend Sage Intacct's already world-class functionality, to create a bespoke solutions that is perfect for your individual needs.

- Extended CapabilitiesSage Intacct's advanced accounting software modules help to further automate and streamline key finance processes like multi-entity consolidation, revenue recognition, inventory control, project accounting, planning, and more.

Sage Intacct Capabilities

ASC 606 & IFRS 15

The general rules of revenue recognition don’t apply to subscription-based companies. Sage Intacct offers the only ASC 606 cloud accounting and billing solution from quote to financial forecast.

It enables you to automate a single revenue stream throughout a customer’s lifecycle, saving hours of painstaking calculations, accelerating your close and reporting, improving accuracy and ensuring compliance.

ASC 606 provides a five-step framework for recognising revenue, to help eliminate some of the confusion in SaaS accounting practices and drive consistency in financial reporting.

ASC 606 five-step model:

-

Identify the contract with a customer

Companies outline the criteria that must be met when establishing a contract to supply services to a customer.

-

Identify the performance obligations in the contract

A summary of how distinct performance obligations and deliverables must be handled.

-

Determine the transaction price

This details the amount the provider expects to receive for providing the contracted services.

-

Allocate the transaction price

This step explains how the transaction price will be allocated across the contract's performance obligations.

-

Recognise revenue when or as the performance obligation is satisfied

In the final step, revenue is recognised as performance obligations have been met and the customer benefits from the service(s) provided.

Must Have Finance Features

SaaS and technology companies have particular accounting needs which are difficult to manage with generic accounting software. When operating a business with a subscription model, it’s important to have software that can track monthly recurring revenue with capabilities for subscription billing and cash flow forecasting, as well as CRM integration.

Accounting Software for SaaS & Tech Providers

Scalability

Because most SaaS business models are growth-orientated, SaaS and tech businesses require an accounting solution that can easily scale alongside the business. Sage Intacct is the easy-to-use cloud software that has been purposefully designed to grow with your needs. Its intuitive modular design offers the flexibility to choose advanced functionality as you need it. Automating and streamlining key accounting processes so you’re always ready for what’s next.

Revenue Recognition

One of the most significant challenges for SaaS and tech providers is knowing when to recognise revenue. Deferred revenue, one-time start-up fees, usage-based billing and mid-term contract changes are just a few of the complexities SaaS finance teams face. Our Sage Intacct solutions will accurately automate your revenue recognition, in line with ASC 606.

Salesforce Integration

The native integration between Sage Intacct and Salesforce CPQ, allows data to be shared between both systems in real-time. Your sales and finance teams can share up-to-date reports for accurate billing and improved customer service, meaning you can spend more time on higher-value, strategic activities.

Let's Talk

Interested in learning more about Sage Intacct for SaaS & Tech?

Complete the form to request a call-back from our team and let’s get the conversation started.