What’s New in the Latest Release?

Percipient Sage Intacct Consultant, Heather-Jayne Corbin, shares her highlights of what

you can expect from Sage Intacct’s fourth and final update for 2024 (R4 2024).

Accounts Receivable

Reconcile Customer Payments & Credits to AR Sales Invoices

Easily see how payments and applied credits match to AR sales invoices using the customer reconciliation report. At a glance, you can see not only how much a customer owes, but also how payments and credits were matched to AR sales invoices.

The customer reconciliation report answers the following types of questions:

- Which credits and payments were applied to a given AR sales invoice?

- Where was a given credit applied?

- Which transactions share a specified match sequence?

- What transactions remain partially matched or not matched at all?

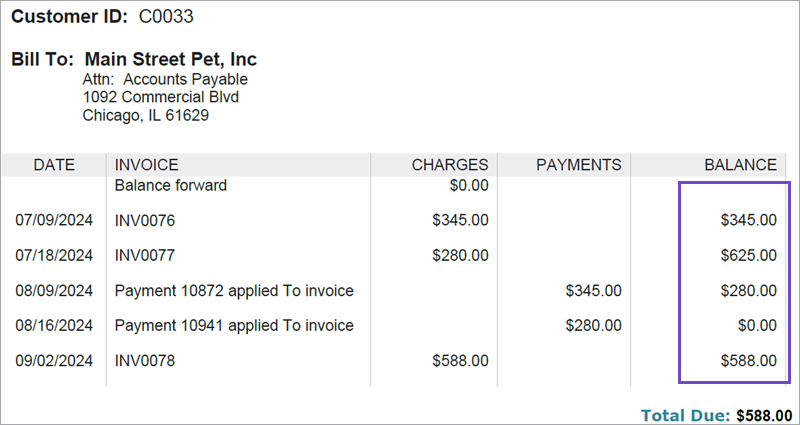

Enhancements to AR Statements

This idea came from you!

Remove the need for customers to perform manual calculations by adding a running balance to your custom statement templates.

Currency symbols now display alongside amounts by default, adding clarity to foreign-currency statements.

Accounts Payable

Reconcile Payments & Credits to AP Purchase Invoices

Easily see how payments and applied credits match to AP purchase invoices using the Supplier reconciliation report. At a glance, you can see not only how much you owe a supplier, but also how payments and credits were matched to AP purchase invoices.

The Supplier reconciliation report answers the following types of questions:

- Which credits and payments were applied to a given AP purchase invoice?

- Where was a given credit applied?

- Which transactions share a specified match sequence?

- What transactions remain partially matched or not matched at all?

Fixed Assets

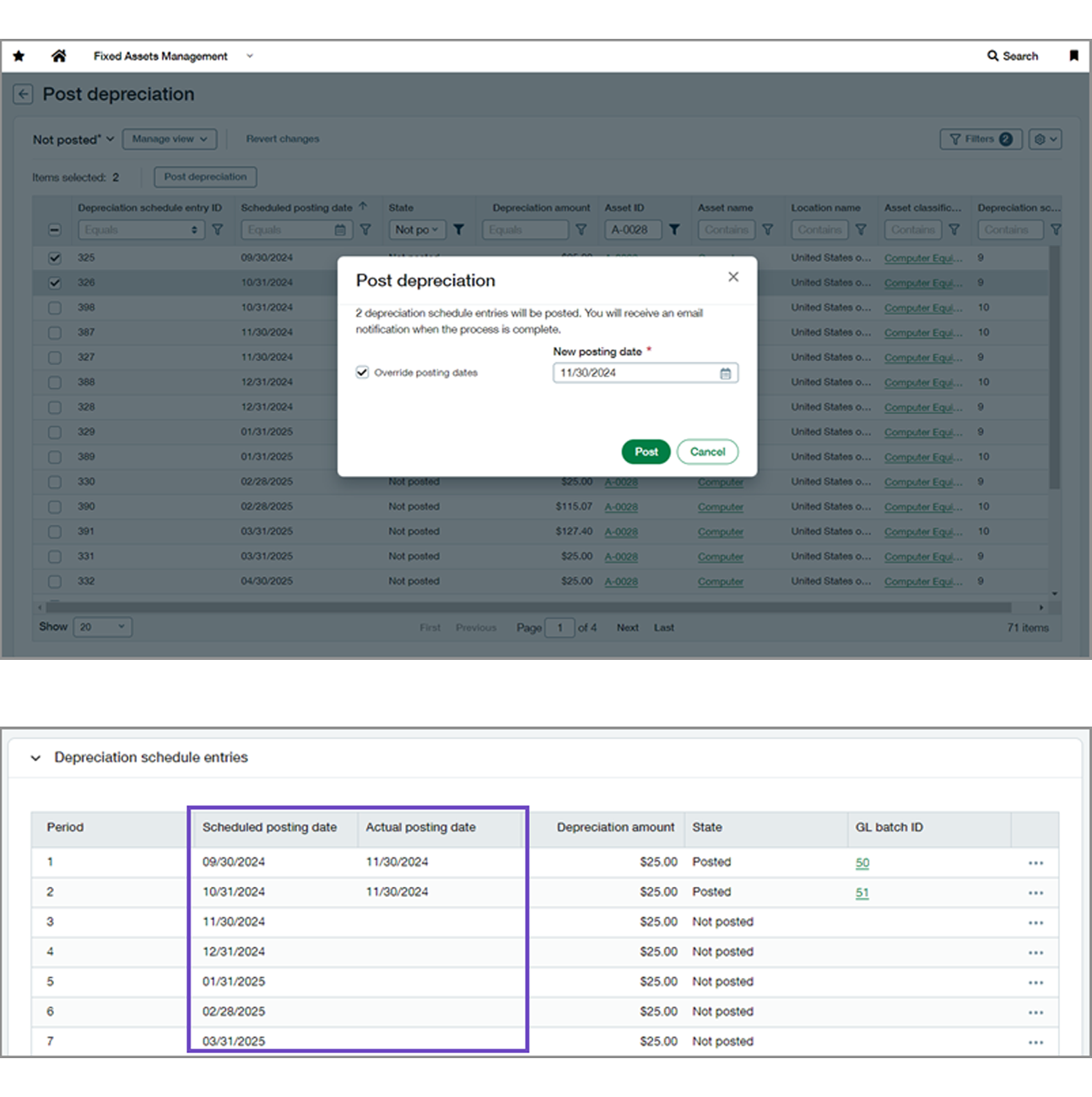

Override Posting Dates

When posting entries from the Post Depreciation page, you now have the option to choose a custom posting date. The new date overrides the scheduled posting dates.

This feature is particularly useful if entries were originally scheduled for a closed period but you need to post them in an open period. Previously, posting entries from closed periods required reopening and closing the books, which can be an inconvenient process.

Taxes

Override Tax Schedules

You can override tax amounts and details in Purchasing and Order Entry to address unusual situations, but sometimes customers need more granular control. Now, companies using Advanced Tax or a VAT tax solution can override the default tax schedule in transaction line items. This lets you calculate taxes for transactions that cross tax jurisdictions, or select a tax schedule when there is no corresponding tax schedule map.

Tax Detail Enhancements for Tax Submission

You can now set the tax detail filing state as Reporting or Not reporting. Transaction line items that use a tax detail set as Reporting will be included in tax submission calculations. Line items with tax details set as Not reporting will be excluded.

User Experience

List Enhancements

Try it!

We’re excited that more customers now have a chance to experience our Lists enhancements in beta. Turn on the Lists beta interface to personalize your list views, leverage advanced filters, manage list and record details side-by-side, and much more.

This functionality is available now on several lists, and we’ve continued to add new lists for this release. We’re rolling out these enhancements to all customers on all of our lists in upcoming releases.

Training

Announcing the First Customer Certification for Sage Intacct

Are you a Sage Intacct accounting expert?

The Sage Intacct Accounting Specialist Certification is open to customers who perform financial transactions and generate reports using Intacct. The certification exam assesses your knowledge of Sage Intacct and the skills outlined in the certification guide.

After passing the exam, you’ll receive a certificate and a badge. You can add these to your email signature, LinkedIn profile, and other platforms to enhance your professional brand and showcase your skills.

Sage Intacct Partner of the Year

These highlights are only a few of the many new features and enhancements that have come to Sage Intacct in release 4 for 2024. If you are a current Sage Intacct customer and want to learn more, you can read the full release notes for R4 2024 here.

The next Sage Intacct release date is due in February 2025. For more information on Sage Intacct or the latest software release, get in touch or call us on 01606 871332.