What’s New in the Latest Release?

Percipient Pre-Sales Consultant, Kody Devlin, shares her highlights

of what you can expect from the second Sage Intacct release for 2025 (R2 2025).

New Rule Type for Named Users in AP Approvals

What it is:

Sage Intacct has enhanced the approval setup process in Accounts Payable. Clients can now easily configure approval rules by individual named users, using the new User Level rule type.

The Rule type column, which previously included rule types and users with AP purchase invoice approval permissions, now contains only rule types. With this update, the list of named approvers is clearly separated, improving visibility and making policies easier to manage.

Example:

If invoices over £5000 need approval by the Head of Finance, users can now directly assign the individuals user profile, instead of using a general “Finance Approvers” role.

How it Works

External Credits Now Reflected in Entity-Level Accounts Receivable Statements

What it is:

Sage Intacct now includes external credits in Accounts Receivable entity-level customer statements.

Previously, all external credits applied to transactions in the entity showed in the reports but only advances and overpayments showed in AR statements run at the entity level. This provides a full and accurate view for Customers viewing their statements.

Example:

If an invoice is raised by Entity A but a related credit is issued by Entity B, the credit will now appear on the customers statement in Entity A.

How it Works

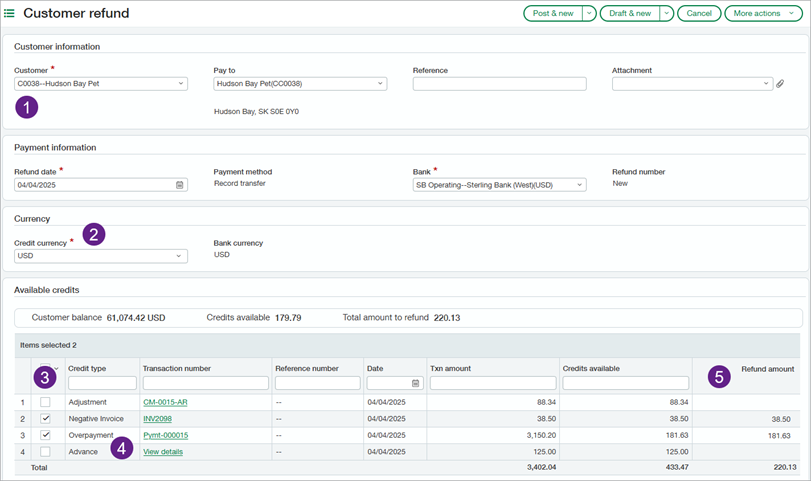

Customer Refund Improvements (Coming Soon) Early Adopter

What it is:

Sage Intacct has announced the ability to record customer refunds, coming soon to Accounts Receivables.

This will allow you to eliminate the tedious step of creating balancing adjustments for refunded credits. Instead, record the amount refunded and pay available credits by simply selecting them.

The Impact for clients is highly beneficial, as it allows increased reporting accuracy, tidier books by closing out credits easily and effectively, easily resolve account inactivity and a full refund audit trail.

Example:

On the new Customer refunds page, record a refund using the record transfer payment method. Enter the amount you refunded and match it to the customer’s available credits. Select from the customer’s available advances, adjustments, overpayments, or negative AR sales invoices, applying amounts partially or in full.

Upon posting, Sage Intacct automatically clears the selected credits, keeping the customer account up-to-date.

How it Works

Affiliate Entity Dimension

What it is:

Sage Intacct introduces the new Affiliate Entity dimension, available in 2025 R2 to customers with the Consolidation subscription. Sage Intacct automatically tags automated inter-entity journal entries, and you can use it to manually tag General Ledger journal entries.

The impact this has is easier intercompany reconciliations, cleaner reporting on due-to/due-from balances, and clear affiliate tracking without manual effort.

By enabling affiliate entity dimension tagging, you enrich and enhance inter-entity activity and balance information. You’ll glean more details such as clearly delineated due to and due from amounts, when you run dimension balance, General Ledger, and financial reports.

Example:

For example, suppose that your management company entity E101 has inter-entity receivables for 15 entities. You can now use the affiliate entity dimension to report on that inter-entity activity and easily reconcile it against the inter-entity payables for all 15 entities. You can do all this using only one inter-entity receivable account and one inter-entity payable account.

How it Works

Sage Intacct Partner of the Year

These highlights are only a few of the many new features and enhancements that have come to Sage Intacct in the second release for 2025. If you are a current Sage Intacct customer and want to learn more, you can read the full release notes for R2 2025 here.

The next Sage Intacct release date is due in August 2025. For more information on Sage Intacct or the latest software release, get in touch or call us on 01606 871332.