What’s New in the Latest Release?

Percipient Pre-Sales Consultant, Kody Devlin, shares her highlights

of what you can expect from the fourth Sage Intacct release for 2025 (R4 2025).

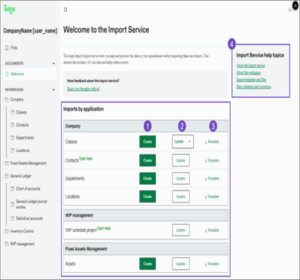

Updates to the Sage Intacct Import Service

What it is:

The Sage Intacct Import Service has been expanded and redesigned to provide a cleaner, more intuitive workflow for importing, validating, and updating data across the platform.

Users can now preview, validate, and correct data before import, reducing the risk of errors and improving overall data hygiene.

Key benefits:

- The ability to use multi-tab spreadsheets and calculation columns that can be skipped during import.

- Real-time error handling, with field- and line-level error messages displayed directly in the worksheet.

- ID update support, allowing you to change key identifiers such as GL account numbers, statistical account IDs, and class IDs without creating duplicates.

- Added and updated imports across Company, Contacts, General Ledger, and Accounts Payable (supplier import now in limited beta).

- A new Limited Beta program also opens access to early import enhancements giving users the chance to test new templates and workflows ahead of general release.

Why it matters:

Data integrity is the foundation of any financial system, and importing is often one of the riskiest points for human error.

These updates make Intacct’s import process far more controlled, auditable, and user-friendly, especially for organisations handling multiple entities or bulk master data changes.

It’s now possible to update IDs and validate records before data touches the live ledger, giving finance teams confidence that every import aligns with their chart of accounts and reporting setup.

For implementation teams, this is also a game-changer for onboarding and migrations, allowing cleaner transitions from legacy systems with less manual correction.

Example:

Imagine a finance manager who needs to renumber their GL chart of accounts after a restructure, moving from departmental codes like “4000-Marketing” to “4100-Marketing UK”.

Previously, this required creating new accounts and manually transferring balances.

Now, using the Import Service’s ID update feature, they can:

1. Export their chart of accounts to a template.

2. Enter the new account numbers in the “ID” column.

3. Import back into Intacct, instantly updating the IDs without losing any transactional history.

Errors (such as duplicate IDs or missing parent accounts) are highlighted in real-time before the import is processed, preventing accidental mismatches.

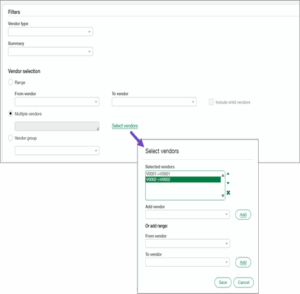

More Filter Options in the AP Ledger Report

What it is:

The AP Ledger report has been enhanced with a suite of new filtering options, allowing finance teams to quickly refine and target supplier data without leaving Sage Intacct.

You can now:

- Select multiple suppliers in a single report run.

- Filter by supplier groups based on custom attributes such as region, payment terms, or category.

- Include child suppliers automatically when filtering by range.

These new capabilities bring the AP Ledger in line with the Supplier Aging report, delivering a consistent and efficient reporting experience across Accounts Payable.

Why it matters:

Running supplier-level reports one at a time can be frustrating and inefficient, especially for businesses managing large supplier networks.

This update eliminates the need to export, merge, and reformat data in Excel, saving valuable time while improving accuracy.

It’s particularly impactful for multi-entity or multi-site organisations who need visibility by supplier group, region, or purchasing category, rather than a single supplier at a time.

Example:

A hospitality group with six hotels wants to analyse total spend with all of its linen suppliers in one view.

Previously, the finance team had to export individual supplier reports and combine them manually.

Now, they can:

1. Open the AP Ledger report.

2. Choose multiple suppliers or a predefined “Linen Suppliers” group.

3. Instantly view one consolidated report showing all invoices, payments, and balances.

The new filtering functionality not only saves time but ensures consistent supplier reporting across every hotel in the group.

Auto-Generated Payment IDs for AP Advances

What it is:

Sage Intacct now automatically assigns a unique Payment ID when posting an AP advance.

This identifier gives every advance payment its own reference number, improving traceability across lists, reports, and reconciliations.

You’ll now see the Payment ID in:

- The Advances list and on each posted advance detail page

- Standard AP reports, including:

- Cheque Register – displayed under Document number

- AP Ledger – displayed under Document number

- AP Aging report – displayed under Bill

If the Cheque number or Reference number fields are empty, Intacct automatically displays the Payment ID in those columns.

This applies to all newly posted advances after setup; existing ones remain unchanged.

Why it matters:

Tracking supplier prepayments and project deposits can be messy when no consistent identifier exists.

By automatically assigning Payment IDs, Sage Intacct creates a single point of reference for every advance, improving reconciliation, reporting, and audit transparency.

For finance teams handling deposits, milestone payments, or recurring advances, this feature means less time hunting for records and fewer mismatched references during reconciliations.

Example:

A property management company pays a £7,500 deposit for new kitchen equipment.

When the advance is posted, Intacct generates ADV-00112 as its Payment ID.

That same ID now appears:

- In the Advances list for easy lookup

- Within the Cheque Register, AP Ledger, and AP Aging reports

- During bank reconciliation, allowing the team to instantly identify and match the transaction

Later, when the supplier’s invoice arrives, the finance user filters by ADV-00112 to confirm the payment was already recorded, no manual searching required.

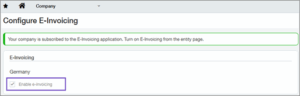

E-Invoicing for Germany (Early Adopter)

What it is:

Sage Intacct now supports electronic invoicing (e-invoicing) for entities operating in Germany, introducing full compatibility with the ZUGFeRD standard.

ZUGFeRD (Zentraler User Guide des Forum elektronische Rechnung Deutschland) is a hybrid file format that combines:

- A human-readable PDF for viewing and archiving, and

- An embedded XML file for machine-readable data exchange.

With this release, finance teams can now:

- Send e-invoices in ZUGFeRD format directly from Accounts Receivable or Order Entry.

- Receive supplier e-invoices in ZUGFeRD format automatically through AP Automation.

- Configure e-invoicing per entity to meet local legal requirements and maintain compliance with Germany’s new digital reporting standards.

Why it matters:

Germany’s e-invoicing legislation makes electronic exchange of invoices mandatory for B2B transactions, beginning in 2026.

This feature ensures Sage Intacct customers remain fully compliant while also improving speed, accuracy, and security in invoice processing.

It’s especially relevant for multinational organisations with German subsidiaries or shared-service finance teams, helping them standardise invoicing processes without third-party tools or manual conversions.

Example:

A UK-based group with a German trading entity issues invoices to domestic German clients.

After enabling E-Invoicing, when the finance user sends an invoice in Intacct:

1. The system automatically generates a ZUGFeRD PDF, embedding the XML data inside.

2. The customer receives the file, which can be opened visually like a normal PDF, but also imported directly into their accounting software for automated posting.

3. On the Accounts Payable side, when a German supplier sends a ZUGFeRD invoice to your AP Automation address, Intacct reads the XML and pre-populates the purchase invoice automatically, reducing manual data entry and ensuring data integrity.

The result: faster invoice turnaround, fewer keying errors, and compliance with German federal e-invoicing rules.

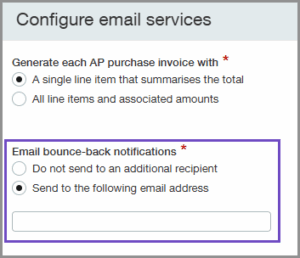

Smarter Email Capabilities for AP Automation with Purchasing

Building on the improvements introduced in the previous release, Sage Intacct now provides a smarter email experience for AP Automation with Purchasing through a new @ai.sage.com email domain.

This enhanced service adds the flexibility and reliability that finance teams have been requesting, with support for new file formats, bounce-back notifications, and automated forwarding rules.

Beginning February 2026, all companies will automatically move to this new domain, but users can opt-in now to take advantage early.

New capabilities include:

- Auto-forwarding rules: Forward invoices automatically from shared inboxes or mail rules, no more manual re-sending.

- Email bounce-back notifications: Receive an alert when a document cannot be processed, so suppliers can be contacted quickly.

- Expanded file format support:

- Extract attachments embedded in the email body.

- Read invoice text within the email body (not only attachments).

- Accept HEIC images (from iPhones) for automatic processing.

Why it matters:

Email submission is the most common entry point for supplier invoices, but until now, rigid file-type rules and missing bounce notifications created bottlenecks.

These new capabilities bring reliability, transparency, and speed to the document capture process, allowing AP and Purchasing teams to manage higher volumes without manual triage.

It’s a particularly strong improvement for hospitality, retail, and service environments where suppliers frequently send varied file types or images from mobile devices.

Example:

A site manager emails a supplier invoice taken as an iPhone photo (HEIC format) to the company’s automation address.

Previously, that email would have been ignored or failed silently.

Now:

1. The system converts and reads the HEIC image automatically.

2. If the invoice cannot be processed, an email bounce-back is sent to the configured notification address.

3. The AP team can reply to the supplier immediately with guidance — or forward the message to the correct address using an auto-forward rule.

The result: fewer lost documents, quicker responses, and cleaner automation queues.

Line-Level Matching Enhancements for AP Automation with Purchasing (Early Adopter)

What it is:

Sage Intacct continues to evolve line-level document matching for AP Automation with Purchasing, available through the Early Adopter Program.

This enhancement introduces greater precision in automatically matching supplier invoices to purchase orders or receipts, reducing manual intervention and improving data accuracy.

New capabilities include:

- Exception visibility: View a clear summary of mismatches between purchase order and supplier invoice line items (e.g. price or quantity discrepancies).

- Editable line entries: Quickly edit or override flagged exceptions directly in the automated transaction.

- Add missing lines: Pull additional lines from source transactions or related documents when AI doesn’t extract all data.

- Multi-source document conversion: Support for adding lines from multiple source documents for complex purchasing workflows.

Why it matters:

Matching supplier invoices to POs can be one of the most labour-intensive parts of the procure-to-pay process.

This enhancement moves Intacct closer to true AI-assisted three-way matching, where the system flags and explains variances instead of requiring users to manually compare PDFs or spreadsheets.

Finance and procurement teams benefit from faster approvals, reduced data-entry effort, and cleaner audit trails, especially when managing large-volume purchasing or recurring orders.

Example:

A catering company receives a supplier invoice for 200 bottles of wine at £8 each, but their purchase order lists the same item at £5 each.

When the invoice arrives via AP Automation:

1. AI identifies the £3 price variance per line and flags the mismatch automatically.

2. The user selects View Exceptions to see the variance summary and can:

Edit the price directly, or

Override the exception if approved by policy.

3. If a missing line wasn’t extracted from the supplier document, they can use Add Lines from Source Transaction to import it from the original PO or receipt record.

This brings precision, visibility, and flexibility to what was previously a manual correction workflow.

Enhanced Transaction Options for Customer Statements

What it is:

When generating customer statements in Sage Intacct, you can now choose which types of transactions to display — giving you far greater control over what your customers see.

This update applies to open-item statements and introduces three new selectable options:

- Show all transactions

- Show open AR sales invoices and credits

- Show open AR sales invoices only

Previously, Intacct automatically included all transactions by default, which sometimes led to confusion or cluttered statements. The new settings provide clarity and customisation for both your internal finance team and your customers.

Why it matters:

Customer statements are a key communication tool between finance and clients, but showing every historical transaction can overwhelm recipients and make reconciliation harder.

With these options, you can tailor statements to show only the information that’s relevant, such as outstanding invoices or credits, improving transparency and reducing follow-up queries.

For internal users, this also speeds up statement generation by removing unnecessary data and makes it easier to focus on items impacting cash flow.

Example:

A professional-services company issues monthly statements to 400 clients. Previously, each statement included every historical transaction, even those fully paid.

Now the AR clerk can:

1. Go to Accounts Receivable > All > Invoices > Print or Email > Statements.

2. Select Open items as the statement type.

3. Choose Show open AR sales invoices and credits.

4. Click View to preview before sending.

Each client now receives a concise, easy-to-read statement showing only their unpaid invoices and any credits, resulting in faster collections and fewer questions.

Combine Debit and Credit Transactions for Easier Matching

What it is:

The 2025 R4 release introduces a powerful new option within Bank Reconciliation Rules the ability to combine debit and credit amounts for more efficient matching.

Previously, if a transaction was recorded in Intacct as both a debit and a credit (for example, when bank fees or short-term reversals occurred), these needed to be matched manually.

With this update, Intacct can automatically combine both sides of the transaction when evaluating reconciliation rules, significantly streamlining the matching process.

You’ll find the new option under:

Cash Management > Setup > Reconciliation Rules → Matching Conditions → “Amount (combine debits and credits)”

Why it matters:

This update reduces manual effort and eliminates one of the most frustrating reconciliation tasks, offsetting debit and credit pairs that effectively cancel each other out.

It’s particularly beneficial for businesses that handle high transaction volumes, daily merchant settlements, or multi-currency cash movement, where small differences or internal reversals are common.

The feature also ensures more accurate automated reconciliations, reducing the risk of unmatched or duplicated entries at month-end.

Example:

A retail business processes hundreds of card transactions daily.

Occasionally, refunds or chargebacks appear as credits in the bank feed that offset debits from the same day’s batch settlement.

Previously, these required manual reconciliation line by line.

Now, by enabling Amount (combine debits and credits) in the reconciliation rule:

1. Intacct groups related debit and credit transactions automatically.

2. When the combined value matches the bank statement line, it clears both items as reconciled.

3. Finance users only need to review exceptions — not every offset transaction.

This simple change can reduce reconciliation time by hours each week.

Include Unposted Journal Entries in GL Reports

What it is:

You can now choose to include unposted journal entries in your General Ledger and Journals reports, giving finance teams greater visibility into work-in-progress adjustments before they’re officially posted.

This new filter option lets you decide which transaction states to include, ensuring you can see the full financial picture, not just posted entries.

Available options under the new filter “Include these transactions” include:

- Posted transactions only

- Unposted transactions only

- Posted and unposted transactions

When you select an option including unposted transactions, you can further specify which states to include (depending on whether approvals are enabled):

- Draft

- Submitted

- Partially Approved

- Declined

This update applies only to journal entries (not subledger transactions).

Why it matters:

Month-end visibility has always been one of the toughest challenges for finance teams.

Previously, draft or submitted journals were invisible in financial reports until they were posted, leading to blind spots during reconciliation, forecasting, or variance analysis.

Now, with this enhancement, Intacct supports a “continuous close” approach, allowing accountants to preview the full financial position, including pending adjustments, before final posting.

It also supports audit compliance, as the report footers clearly show which filters were applied, ensuring transparency.

Example:

A finance manager is preparing management accounts mid-close. Several journal entries for accruals and prepayments are still awaiting approval.

By running the General Ledger report and selecting:

“Include these transactions → Posted and Unposted Transactions”

The manager can:

1. Preview both approved and pending journals in a single view.

2. Filter specifically for Submitted or Partially Approved entries.

3. Spot missing or incorrect postings early — before finalising the month.

This allows for faster decision-making and reduces the risk of surprises once the close is complete.

Updated Formatting for Charts and Graphs

What it is:

Sage Intacct has introduced behind-the-scenes improvements to the way charts and graphs are displayed across the system, particularly within the General Ledger and reporting dashboards.

While these updates don’t introduce visible new functionality yet, they modernise Intacct’s chart rendering framework, setting the stage for future enhancements in visual analytics, dynamic dashboards, and AI-driven insights.

Users may notice subtle changes such as:

- Cleaner bar and line graph rendering.

- Improved label spacing and alignment.

- More consistent scaling and legend positioning across dashboard components.

Why it matters:

Though minor on the surface, this update is a key step toward a smarter, more flexible reporting experience in future releases.

By updating the underlying graphing engine now, Sage ensures that dashboards and performance cards will support more advanced data visualisations, trend overlays, and AI-powered forecasting tools later in 2026.

For finance teams, this means better performance and reliability today, and a platform ready for the next phase of Sage’s analytics roadmap.

Example:

A finance user opens their P&L dashboard and notices the bar charts for Revenue by Location and Expense Trends render more sharply and align more cleanly when resizing the screen.

The data and filters behave exactly as before, but the charts now:

- Scale dynamically without truncating labels.

- Retain formatting across browsers and resolutions.

- Respond more fluidly during dashboard refreshes or drill-down actions.

It’s a smoother, faster experience, and an early signal of what’s coming with future visual reporting enhancements.

Support for Term Discounts for Taxes (General Availability)

What it is:

Sage Intacct now allows businesses to apply and calculate taxes on term discounts directly within the Taxes application.

This feature is available for both standard and custom tax solutions, giving you greater flexibility to comply with regional tax rules that specify how discounts impact taxable amounts.

You can now define how the tax is treated when applying early payment discounts using a new “Calculation Method” option in Accounts Receivable Terms or Order Entry Terms.

Available calculation methods include:

1. Line-items total, excluding taxes – applies the discount only to the net line-item amount (no tax impact).

2. Line-items total, including taxes – applies the discount to the line item and its associated tax amount.

3. Invoice total, including taxes and added charges – applies the discount to the full invoice total (including all taxes, shipping, and charges).

This enhancement ensures tax is correctly recalculated based on how the discount is applied, with the system automatically creating or omitting correcting tax records as needed.

Why it matters:

Different jurisdictions have different rules on whether discounts should reduce taxable value.

Previously, businesses had to manually adjust their calculations or rely on external spreadsheets to ensure compliance.

Now, Sage Intacct handles it automatically.

This helps organisations:

- Stay compliant with local tax authorities.

- Eliminate manual adjustments and rounding errors.

- Provide consistent accounting treatment across all entities.

It’s particularly valuable for companies operating in multiple tax regions or industries where early-payment discounts are common, such as distribution, manufacturing, and hospitality supply chains.

Example:

A supplier issues a £1,200 invoice (including £200 tax). The customer is offered a 10% term discount if payment is made within 10 days.

If the term is set to “Line-items total, including taxes”, when the payment is made within the discount window:

1. The discount applies to the total (£1,200 × 10% = £120).

2. The system automatically adjusts the taxable amount and creates a correcting tax record for the reduction.

If instead it’s configured as “Line-items total, excluding taxes”, the £120 discount applies only to the net (£1,000), leaving the £200 tax unaffected, with no correcting tax record created.

This precision ensures accurate reporting and VAT/GST returns without manual recalculation.

Coming Soon:

Close Workspace & Sage Copilot Email Drafting

What it is:

Two exciting features are being introduced as part of Sage Intacct’s next release phase (available November 2025), both designed to streamline finance operations and further automate the close process:

1. Close Workspace (General Availability)

A centralised workspace that allows finance teams to plan, manage, and track the entire financial close process within Sage Intacct.

It brings together close checklists, tasks, approvals, and real-time progress tracking across entities, all in one interface.

2. Sage Copilot for Email Drafting

Sage Copilot, Intacct’s embedded AI assistant, can now automatically generate email notifications and summaries for both Close Workspace and Variance Analysis.

This helps finance teams communicate updates, escalate issues, and summarise results, all without leaving the system.

Why it matters:

These two features are part of Sage’s broader strategy to enable a “continuous close”, where finance teams operate in real time, not just at month-end.

- Close Workspace provides structure and visibility, helping controllers and CFOs understand exactly where the team is in the process and what’s outstanding.

- Copilot email drafting uses natural language AI to save time on repetitive communication tasks, such as sending reminders or summarising close progress for stakeholders.

Together, they’ll make close management more efficient, auditable, and collaborative.

Example:

A Group Financial Controller overseeing five entities uses Close Workspace to manage month-end.

Each accountant has their assigned tasks, with automatic progress tracking and completion alerts.

When the controller reviews the workspace:

- Copilot detects that key reconciliations are complete and automatically drafts a summary email:

“All reconciliations for UK and Ireland entities have been reviewed and approved. Remaining actions: intercompany eliminations and final variance analysis.”

The controller can review, edit, and send the message directly from within Intacct, no copy-paste or reformatting required.

Multi-Award Winning Sage Intacct Partner

These highlights are only a few of the many new features and enhancements that have come to Sage Intacct in the final release for 2025.

For more information on Sage Intacct or the latest software release, contact us or call us on 01606 871332.