Percipient’s Sage Intacct Lead Consultant, Stephen Little, shares his highlights of what you can expect from Sage Intacct’s third update for 2024 (R3 2024).

What’s new in the latest release?

Platform Services

New fonts available for printed document word templates

We’re excited to announce the addition of new fonts available on our servers for use in printed document Microsoft Word templates.

These new fonts include:

- Libre Barcode 39 Extended

- Libre Barcode 128

- Cordia New

Accounts Payable

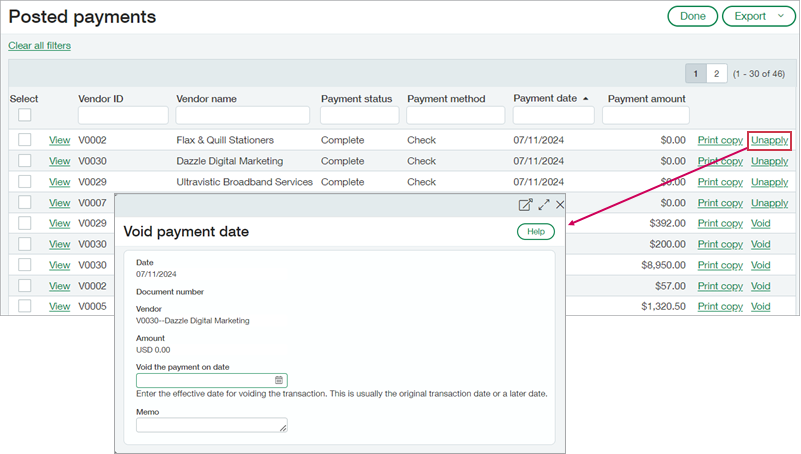

Unapply credits in Posted payments

Improve workflow efficiency by unapplying credits from Posted payments, when the credits are applied without an associated payment.

You can unapply credits of all types, including the following:

- Advances

- Debit memo adjustments (supplier credits)

- Negative AP purchase invoices

- Negative line items applied from one AP purchase invoice to another AP purchase invoice

After you unapply a credit, the credit is available to apply to other AP purchase invoices.

Accounts Payable

Void a payment directly from the Posted payments page

Save time by voiding posted payments directly from the Posted payments page.

Previously, the method you used to void a payment depended on the payment method. That might require voiding the payment from the Cheque, Bank, or Credit card register report, or from Manual payments.

Now, the Void link is conveniently available on the Posted payments page, where you typically view the completed payments. No Cash management permissions are required to void the payment.

Cash Management

View all unmatched transactions immediately during reconciliation

We changed your default view on the Reconcile account pages! When you open the Reconcile bank account page or the Reconcile credit card account page, the Transaction type filter now defaults to All, revealing all your unmatched transactions for easy viewing and management. Previously, the default filter only showed unmatched cheques and debits.

General Ledger

Easy access to Sage Intacct Planning

Sage Intacct Planning (SIP) is an add-on application that offers a collaborative environment for preparing and managing budgets.

You can now access the Sage Intacct Planning log-in page directly from the Budget planning page.

Company and Administration

Enhanced email delivery and insights

We’re excited to announce the release of the Sage Intacct enhanced email delivery service!

The enhanced email delivery service uses DKIM, the industry-leading standard for email security. DKIM ensures that your emails are delivered to their intended recipients quickly and reliably. Additionally, our enhanced email log provides you with detailed visibility into the delivery status of your emails, by recipient.

Details

To start using the new email delivery service, you authenticate your domain and enter your DNS keys. The enhanced email delivery service also supports multiple domains.

After you authenticate your domain, you can send emails not only from the main domains but also from any sub-domains associated with it. For example, if you authenticate domain.com, you’ll be able to send authenticated emails from sub-domains like billing.domain.com or invoice.domain.com.

Purchasing

Trace original transaction documents

Purchasing workflows provide great flexibility with multiple potential transaction entry and exit points. Now you can easily track which transaction started a workflow. A more traceable workflow ensures greater inventory reconciliation accuracy.

Details

Being able to trace original documents in your purchasing workflows ensures that you can:

- Identify the original transaction in the workflow (originating document).

- Refer back to the previous document in the workflow (source document).

- Generate more informative purchase transaction reports.

- More easily identify and report on reconciliation issues and take corrective action.

Inventory Control

Enhanced reporting options

Inventory utilities help you keep track of inventory changes to quantity and value, and identify potential discrepancies. Report enhancements now include the date a GL entry was entered and any transactions which do not have a corresponding quantity or value entry.

Details

Generate more valuation detail in your reports:

- Transactions Posting to the GL and Inventory Valuation reports: The Creation date column provides insight into any transactions which were back-dated (reflecting a different date from the transaction’s document date).

- Running Average Cost report: Refer to the Unmatched column to identify transactions without a match, such as an incoming transaction to increase quantity without a corresponding value. If there is no corresponding transaction, the Unmatched column displays Yes.

Taxes

Important changes in UK tax reporting for reverse charge

To support updates in Sage Regulatory Reporting, we refined the workflow for reporting input and output taxes on reverse charges.

Details

Previously, when you used Sage Intacct to prepare your tax submission, Sage Regulatory Reporting ignored the output values and used the input values to report both input and output taxes.

Due to recent changes to support reverse charge and partial exemption, Sage Regulatory Reporting now accepts and calculates for both input and output values. This means that when you post a reverse charge, instead of only using input tax details, you must now use input and output tax details so that the taxes are reported to the correct boxes.

You can do this by using the Multiple taxes on line checkbox and entering the input and output tax details and amounts on separate lines.

This updated workflow affects all reverse charge transactions.

Sage Intacct Partner UK

These highlights are only a few of the many new features and enhancements that have come to Sage Intacct in the latest release. If you are a current Sage Intacct customer and want to learn more, you can read the full release notes for R3 2024 here.

The next Sage Intacct release date is due in November 2024. For more information on Sage Intacct or the latest software release, get in touch or call us on 01606 871332.